Leasing

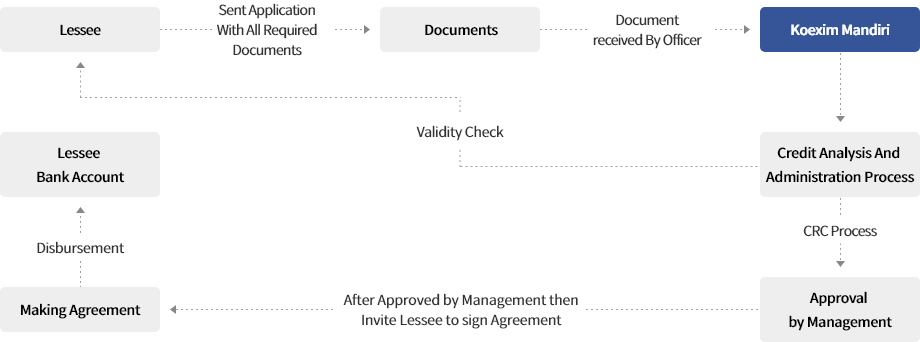

Leasing is the core business of KMF. It helps companies get financial assistances in form of procuring new machineries, adding working capital or other purposes related to their core business. Moreover, leasing could do tax saving as the lease interest shall be treated as tax deductible.

Although there are two principal types of leasing arrangement - a finance lease and an operating lease - KMF is mainly focusing on finance lease with sale and lease back transaction. The principal purpose of a finance lease is to finance the use of equipment for the major part of its useful life. The borrower (lessee) has the right to use the equipment while the lessor (KMF) retains legal title. Lessee could choose the type of equipment, the supplier, model and any special features required then to negotiate with the supplier the terms of warranties, maintenance arrangement, delivery, installation and most importantly, the purchase price of the equipment. KMF will provide the finance to meet the purchase price. .

With sale and lease-back transaction, the equipment user sells to a leasing company to which it already has title and which has a reasonable remaining useful life. The leasing company then leases the equipment back to the user, which then becomes the lessee. An obvious feature of a sale a lease-back arrangement is that a business retains the usage of equipment while disposing of ownership.