ESG Investment

GREEN

Hydrogen Energy, Solar Energy·Wind Power, Rechargeable Battery·ESS, Future Mobility

DIGITAL

PharmaceuticalsHealthcare, 5G·Next Generation Semiconductors, Digital·Contents

In order to reinforce Korean companies' global market position in the green and digital new deal sectors and foster their sustainable ESG management, KEXIM committed a total of KRW 50 billion in two funds. The collective AUM of these funds stands at about KRW 800 billion as of 2021. In addition, KEXIM, together with ESG rating agencies, provides support with ESG diagnosis and ESG improvement measures so that the private sector portion in the funds is directed to socially responsible investments.

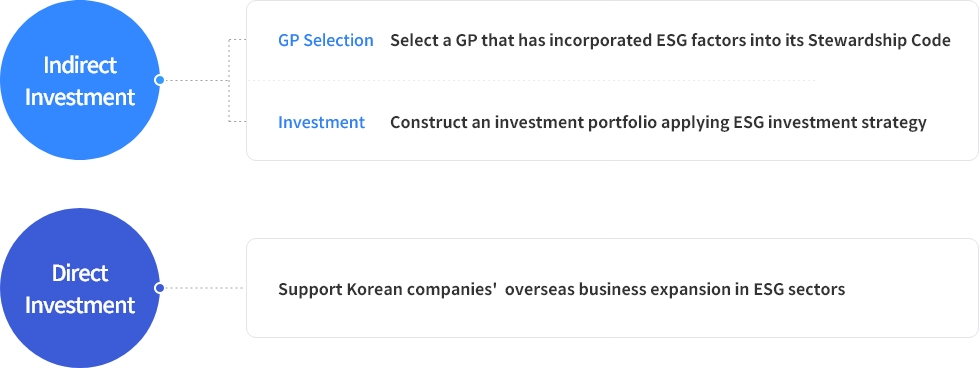

Diagram of Global ESG Investments

KEXIM plans to create the ESG-related funds in 2022 as well and will continue to assess ESG factors such as ESG investment plan and ESG management system when selecting fund managers. Also, KEXIM will expand its direct investment in the ESG sectors by utilizing diverse investment methods such as equity investment and convertible bonds. In doing so, KEXIM will induce fund managers themselves to incorporate ESG factors in their socially responsible investments. This will in turn promote Korean companies to internalize ESG values and reinforce their underlying soundness, thereby supporting overseas expansion of Korean companies in the ESG sectors.

Indirect Investment

- GP Selection Select a GP that has incorporated ESG factors into its Stewardship Code

- Investment Construct an investment portfolio applying ESG investment strategy

Direct Investment

Support Korean companies' overseas business expansion in ESG sectors