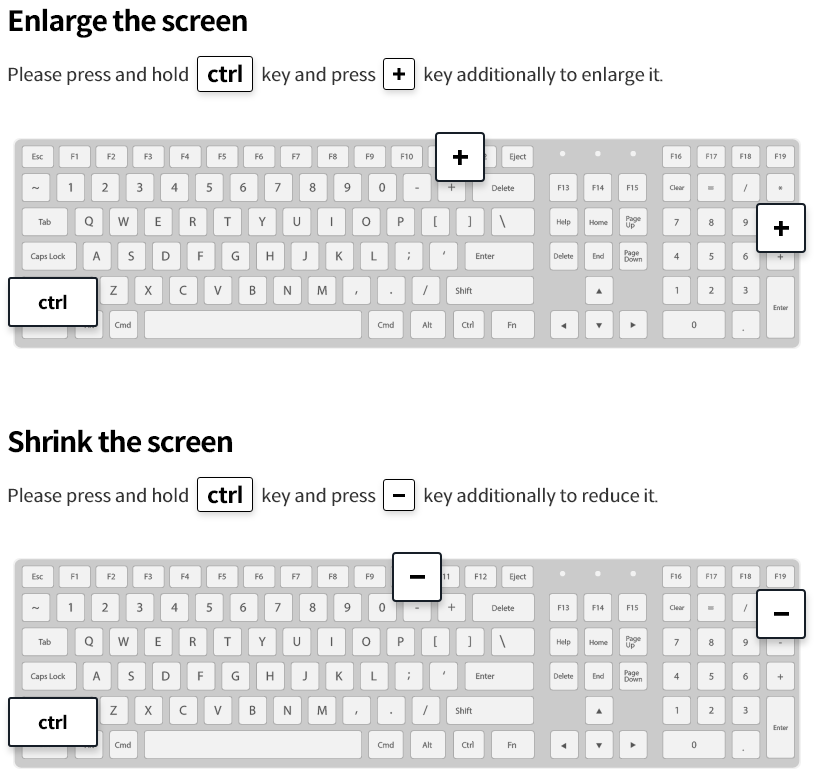

How to enlarge/reduce the letter size

E-Mail this

Did you find useful information at KEXIM?

Recommend the information you see now to anyone you want to share with.

After entering the following details, you can share contents by clicking "SEND"

@

@