Structured Trade Finance for Trade with Korean Companies

Factoring

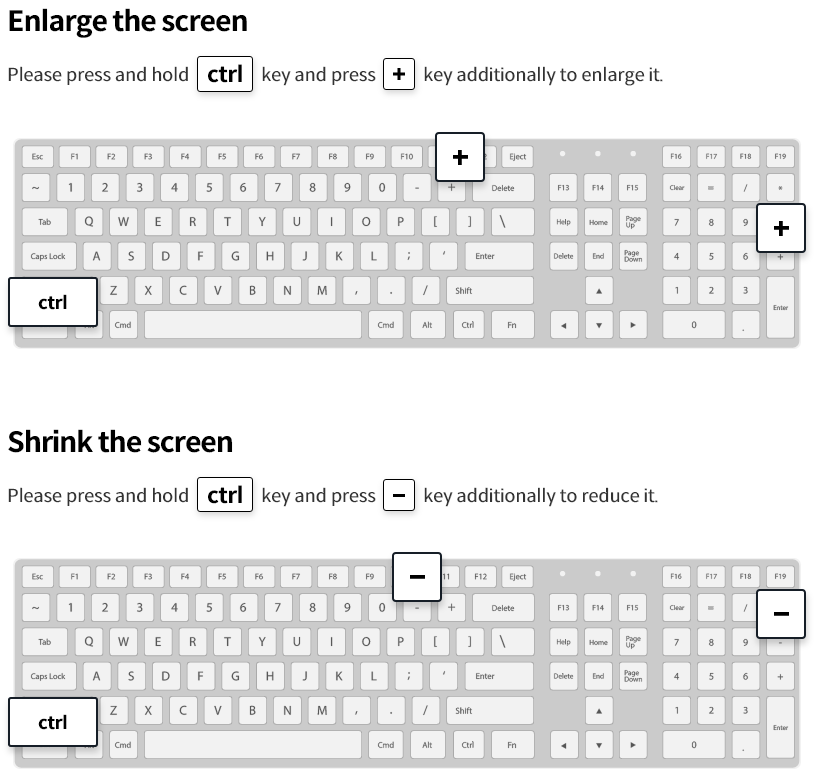

Export Factoring

A form of trade financing provided by purchasing trade bills which occur from on credit (including transactions on s D/A basis), on a

- Discount rates (Libor + Margin) and Factoring fees are charged. The applicable margin is determined considering the creditworthiness of the buyer.

- Eligible tenure of trade bills: less than 180 days.

- KEXIM Bank(UK) Ltd. → Reconciliation and Settlement → Seller(Korea Co. or Korea Co.’s Subsidiary) → Delivery of Goods and lssuing invoices → Buyer → Payment of Proceeds → KEXIM Bank(UK) Ltd.

- KEXIM Bank(UK) Ltd. → Payment for Receivables → Seller(Korea Co. or Korea Co.’s Subsidiary) → Notification of Receivables Sale and Collection Account → Buyer → Payment of Proceeds → KEXIM Bank(UK) Ltd.

- Buyer → Acceptance Letter → Seller(Korea Co. or Korea Co.’s Subsidiary) → Purchase Request → KEXIM Bank(UK) Ltd.

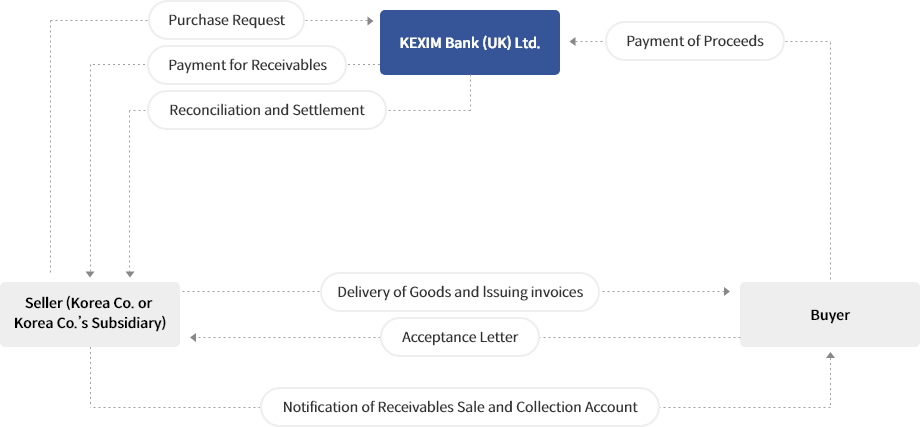

Import Factoring

A form of guarantee or cover in favour of an eligible buyer in the U.K or Europe in connection with Korea Eximbank’s export factoring business. Under normal circumstances, the Bank also acts as a factoring collection agent.

- Fees are determined depending upon the creditworthiness of the buyer.

- Eligible tenure of trade bills : less than 180 days.

- Importer (UK or Europe) → Delivery of Goods Issuing Acceptance Letter → Korean Exporter

- Purchase Request Payment → Korean Eximbank → Credit Cover Request → KEXIM Bank(UK) Ltd. → Credit Cover Approval Notice → Korean Eximbank

- Purchase Request Payment → Korean Exporter

Forfaiting

Forfaiting is financing to exporters in the from of discounting trade bills from export transactions under the Letters of Credit issued by banks in developing countries on a non-recourse basis.

- Eligible banks more than 330 banks in 55 countries

- Eligible tenure of trade bills : 30 days ~ 2 years