Background

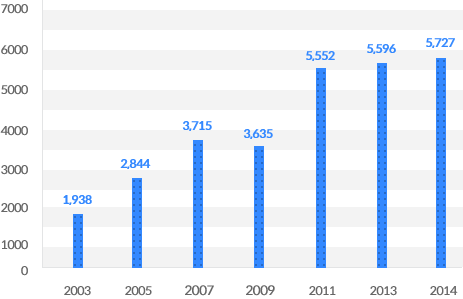

Korean exports have been increasing steadily except for 2009 when the world economy was in recession. Exports have also been the engine driving the Korean economy for 11 years (2003~2014),

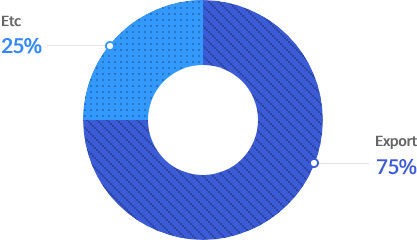

with the standing at 75% as of 2014.

Exports

Contribution to economic growth

Data from Ministry of Knowledge Economy,

Bank of Korea

Such figures, however, mask a structural problem that may undermine future growth.

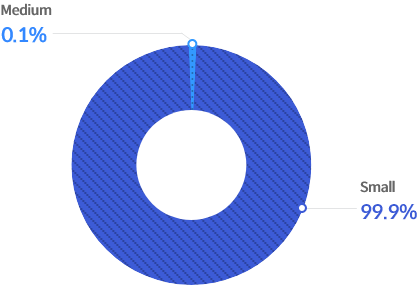

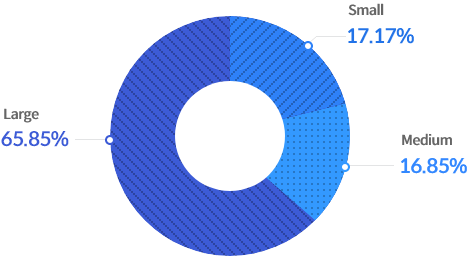

Korean exports rely disproportionately on the performance of large companies. Large companies accounted for 0.1% of all Korean businesses in 2012 but their sales in exports accounted for 65.9% of total Korean exports. On the other hand,

while SMEs and medium-large companies made up 99.9% of all Korean companies, they only accounted for 34.1% of total exports.

Share of companies by size

Share of exports

Data from Statistics Korea, SMBA

Such over-reliance on large companies has led to a weakening of the contribution of exports to the national economy.

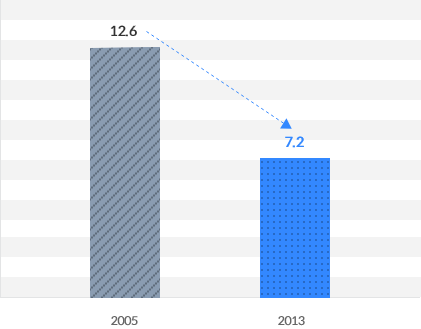

The number of jobs created for KRW 100 million in exports has plunged by 75.7% from 22.2 in 1995 to 5.4 in 2012.

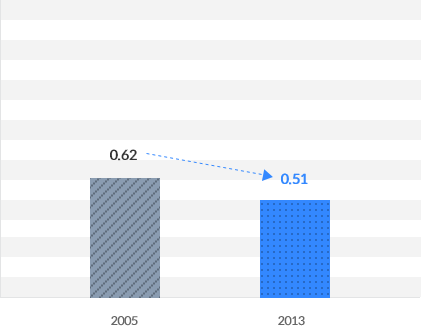

Likewise, the value-added inducement coefficient of exports has fallen sharply by 26.4% from 0.698 in 1995 to 0.514 in 2012.

The value-added inducement

coefficient of exports

The employment inducement

coefficient of exports

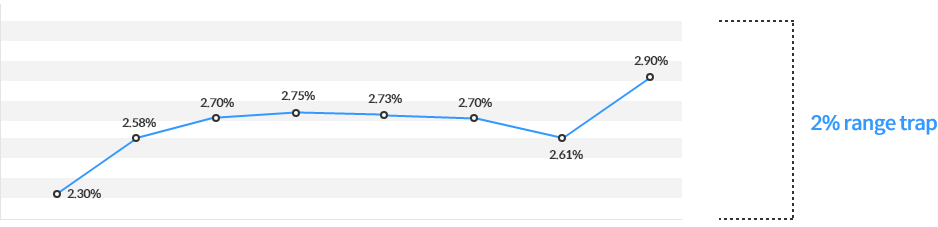

Finally, the global market share of Korean exports has been trapped below the 3% mark ever since breaking through the 2% threshold in 1988.

The spike in global market share in 2009 was due to the exceptional performance of large companies exporting cars, display panels, mobile handsets, semiconductors, and ships.

Share of Korean Exports in the Global Market

Share of Korea Exports in the Global Market

Data from WTO

Exports have thus led Korea's economic growth, but SMEs which constitute the backbone of the Korean economy have been largely excluded from this

export-led growth story. In searching for a remedy for this situation, Korea Eximbank stumbled on the concept of 'Hidden Champion'.

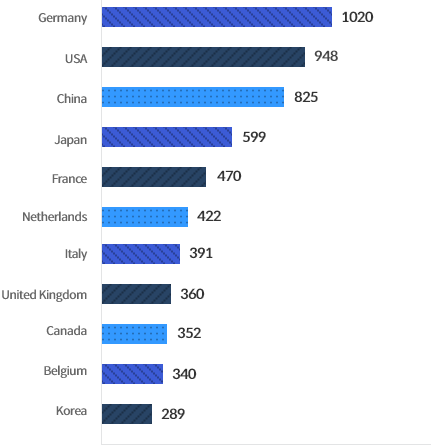

Dr. Hermann Simon, a world-renowned professor of business administration, in his book 'Hidden Champions: Lessons from 500 of the World's Best Unknown Companies,' attributed Germany's success as an exporting nation

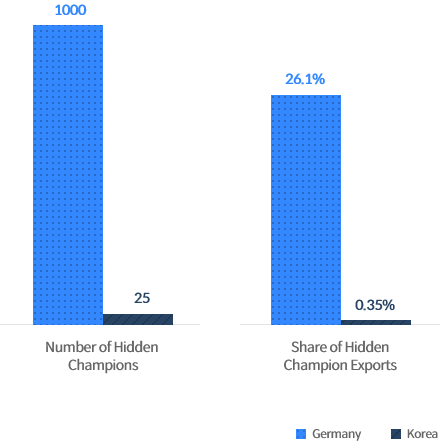

to the existence of about 1,000 Hidden Champions, or SMEs with little public recognition that are focused on one or two product categories, but which dominate the global markets in their respective segments.

In contrast to Germany, Korea has just 25 Hidden Champions. Furthermore, whereas exports of German Hidden Champions accounted for 26.1% of all German exports, those of Korean Hidden Champions (KHC) accounted for just 0.35% of all Korean exports.

2002~2008 average exports (USD billion)

Germany vs Korea

Data from 'Hidden Champion', A.T.Keamey report (2007)

The German example illustrates the substantial contribution medium-sized businesses can make to the growth of exports and to job creation.

In short, Hidden Champions represent the way forward for the Korean economy.

Korea Eximbank therefore developed the Hidden Champions Initiative as a program to incubate Korean-type Hidden Champions,

with the broader aim of promoting an environment of sustainable and balanced growth in which upwardly mobile SMEs can play a robust supporting role in the Korean economy.